這段時間以來,有不少外貿人苦于買家做好了貨但拖著不發。

確實,運價水漲船高,買家如果要貨不急,肯定會選擇先拖上一拖,等運價降了再出貨;然而,貨做好了放哪里?艙位依然訂不到怎么辦?尾款什么時候能付全?

這些問題與風險,讓身處其中的外貿人吃不下、睡不著。

眼瞅著傳統的海運旺季即將到來,疊加當前深圳、廣州的局部疫情,以及東南亞疫情影響港口作業,買家望眼欲穿的艙位和降價,仍遙遙無期。

此時該如何勸說買家盡快出貨?

核心觀點有以下三個:

1. 傳統海運旺季來臨,未來很可能拿著錢都訂不到艙;

2. 受疫情影響,歐美港口擁堵短期內無法緩解,海運費用還要漲;

3. 歐美買家們的進口量再創新高,競爭對手們可沒等著,正在進貨搶占市場。

英文話術和實錘都給你準備好了!

#艙位緊張

As we all know, the peak shipping season for importers happens during the second half of the year. But cargo demand far exceeds available capacity this year, and the vessel space in Asia is getting even tighter in June.

眾所周知,航運旺季即將到來,但今年的需求遠超運力,亞洲出發的航線艙位在6月已經非常緊張。

Historically, it is booked around two weeks in advance, but it is now taking four to six weeks and sometimes up to eight weeks.

通常情況下,人們提前兩周訂艙就好,但現在要提前4-6周,甚至8周才能訂到艙位。

實錘

JOC.com文章:《混亂的海運市場迫使貨運代理租船》

這篇文章主要介紹了貨運代理們為了增加運力所做的努力,分析指出,實際上海運轉鐵路和空運還是太貴了。

原文地址:

https://www.joc.com/maritime-news/chaotic-ocean-market-driving-forwarder-ship-charters_20210521.html

#運價狂飆

Freight rates from Asia to the US and Europe have surged above previous records as strong booking activity and limited supply. Major ocean carriers even filed for an eye-popping $3,000 GRI in June.

由于需求強勁但運力有限,亞洲-美國/歐洲航線的運費已飆升至歷史最高,船東們甚至還在6月將GRI調升至令人瞠目結舌的3000美元/箱。

The Shanghai Containerised Freight Index (SCFI) hit new highs on June 4th. No one konws how much higher spot rates can go.

上海出口集裝箱運價指數(SCFI)在6月4日沖上新高,沒有人知道運費的極限在哪里。

實錘1

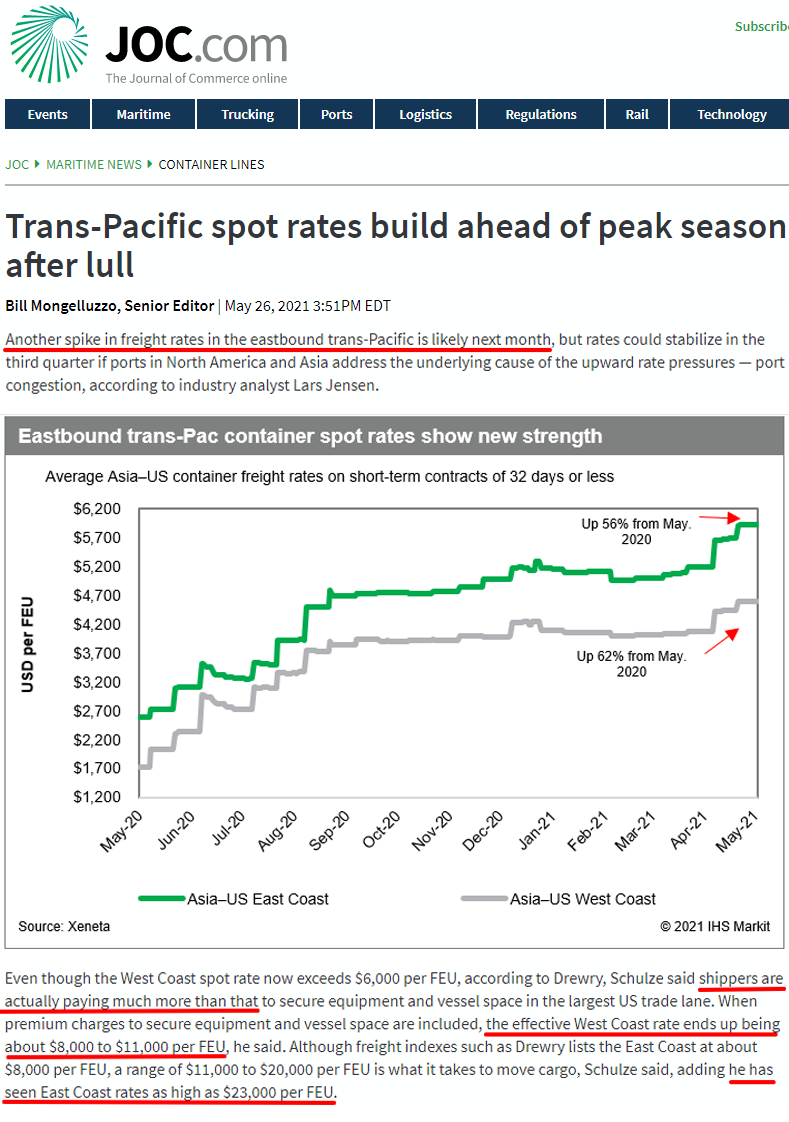

JOC.com文章:《跨太平洋航線運費在旺季前已開始飆漲》

JOC是國際上比較權威的集裝箱貨運領域信息提供商,它出品的文章質量很高。這一篇詳細分析了亞洲-美國航線的運價漲幅,非常適合發給買家參考。

原文地址:

https://www.joc.com/maritime-news/container-lines/another-spike-eastbound-trans-pac-freight-rates-likely_20210526.html

實錘2

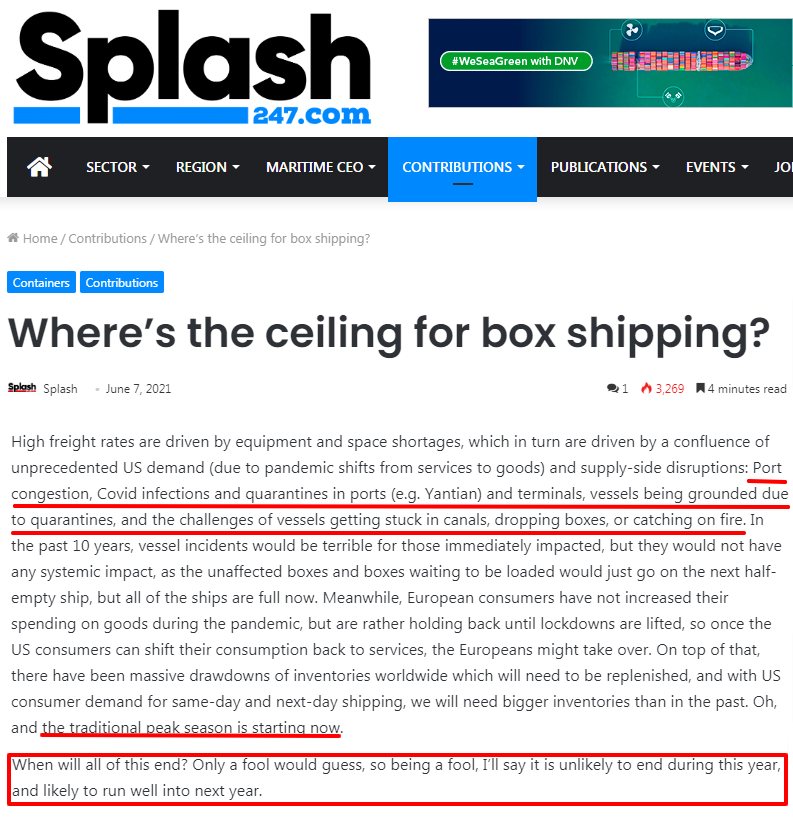

Splash文章:《運價的天花板到底在哪兒?》

這篇文章甚至就直說了:這瘋狂的運價今年都不太可能結束。

原文地址:

https://splash247.com/wheres-the-ceiling-for-box-shipping/

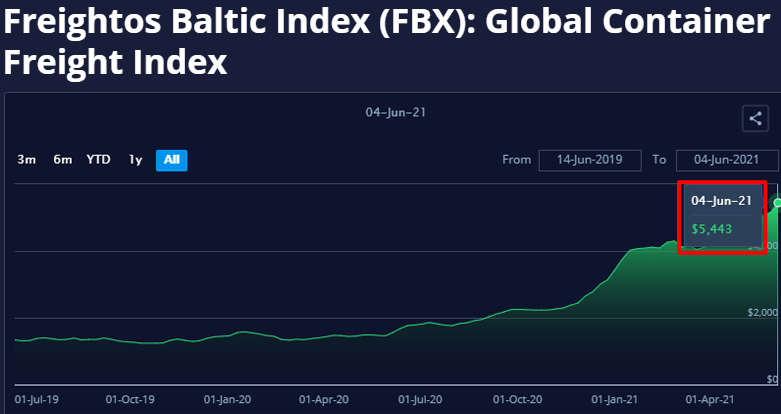

實錘3

多項重磅海運指數

具體包括:

上海出口集裝箱運價指數(SCFI);

波羅的海全球集裝箱指數(FBX);

德魯里世界集裝箱綜合指數。

這三個指數均為航運界的權威指數,具體圖表請見文末的打包文件下載。

#進口大增

The world is experiencing a supply chain nightmare. There are shortages in a bunch of different goods and components. The import wave is coming.

全球供應鏈都在噩夢中,所有商品、零件都面臨短缺,進口潮已來襲。

As retailers struggle to catch up, imports could be capped in the months ahead by the shipping network that has reached its limit. That, in turn, implies more premium charges and even higher all-in costs for importers.

零售商正在努力補足庫存,未來幾個月,進口都會飽受運力之限,這也意味著進口商將承受更高的成本。

High freight rates and tight capacity are currently common problems for all importers. They can not be alleviated in the short term. Putting off importing can not help, but may miss the opportunity of the market and even face another shipping cost increase.

當前海運運費高漲、艙位緊張是所有進口商共同的難題,并且短期內無法緩解,進口商延遲進口并不能解決問題,反而會錯失搶占市場的先機,甚至將面臨海運成本的再度上漲。

實錘1

American Shipper文章:《是時候為圣誕進貨旺季做準備了——盡管進口爆棚,零售銷量仍超庫存增長》

這篇文章非常適合發給美國客人看,它詳細分析了美國零售市場的庫存量和銷售量的對比,顯示出進貨量趕不上庫存量,雖然大家已經在瘋狂進貨了。文章說:“你也不想圣誕節時才發現自己的禮物還在中國港口吧!”

原文地址:

https://www.freightwaves.com/news/time-to-start-prepping-for-christmas-shipping-capacity-crunch

實錘2

AJOT文章:《為跟上消費者需求,美國進口貨物創下紀錄》

這篇文章直接上數據說明美國近幾個月的進口量有多恐怖。

原文地址:

https://ajot.com/news/retail-cargo-continues-setting-records-as-supply-chains-struggle-to-keep-up-with-consumer-demand

本文來源于搜航網,不代表九州物流網(http://www.zgslfm.com)觀點,文章如有侵權可聯系刪除